- Part-Time Tech

- Posts

- Why Product Market Fit (PMF) isn’t enough

Why Product Market Fit (PMF) isn’t enough

And what it has to do with my new startup

👋 Hey everyone! It’s been a minute. I’ve been busy building a new startup (see more on that below) so this newsletter has been a bit on the backburner. But we’re back with a post I’ve been queuing up for a while. Hope you enjoy.

⭐️ Today’s Sponsor

Lizzy Sleep app: Teach your child how to sleep independently

Hey parents - are you tired of having to feed your baby to sleep, waking up in the middle of the night, or crawling out of your baby’s room at night like a ninja?

Lizzy Sleep can help you teach your child independent sleep skills so you BOTH can sleep better. It doesn’t have to be so complicated or scary.

Lizzy gives you a personalized sleep plan and 24/7 chat to help establish the fundamentals of good sleep while helping you troubleshoot all your sleep questions. It’s tailored to your child and what you are comfortable as a parent.

Links ⛓

Flexible Founding Engineer/Co-Founder Role - Read til the end for details

PT Designer and Engineer Roles @ Gumroad - Flexible hours, high rates $100-200+/hr

August Hacker News Freelancer Thread - Monthly thread for people seeking freelancers, or seeking freelancer work

Approaching fractional work as a go-to-market exercise - Good post on some of the nitty gritty on switching to fractional employment

In the startup world, product market fit is considered this magical moment when things ‘click’. You start to feel confident you have a product that fits a customer and market need and can scale up. Time to take this rocket ship to the moon 🚀.

Well, the reality is PMF is not sufficient as a concept to capture the point when a business is ready to start accelerating towards some successful outcome or stasis.

It’s missing two F’s.

Enter: PMFFF

Product Market Founder Funding Fit. Ahhh it rolls off the tongue.

Product Market Fit is great, but if it doesn’t fit the founder’s (or founders’) personal and financial goals, chances are that startup will fail. If what you’re building and the types of markets you’re entering leads you to create a business that doesn’t fit your skills or wants, it’s near impossible to have the persistence and discipline to keep a startup alive.

Product Market Fit is great, but if it doesn’t fit the startup’s funding model and definition of success, chances are the startup will fail. The startup world is littered with great products that made a ton of money, but were never profitable or couldn’t justify its valuations or investments. Especially now that we’re Post-ZIRP, there are tighter constraints on what will lead to a ‘successful’ outcome.

Conversely, there are many startups that had great aspirations but couldn’t raise enough money for what was a capital intensive endeavor.

PMFFF forces founders to be brutally honest with themselves. What do you really want from this business? Are you aiming for a sustainable, long-term venture, or are you chasing a big exit? What funding model aligns with your goals and the nature of your product? It's like finding the sweet spot in a four-way Venn diagram – product, market, founder goals, and funding model, all need to align.

PMFFF: The Good, the Bad, the Ugly

There are plenty of famous examples of startups that found PMF but not PMFFF.

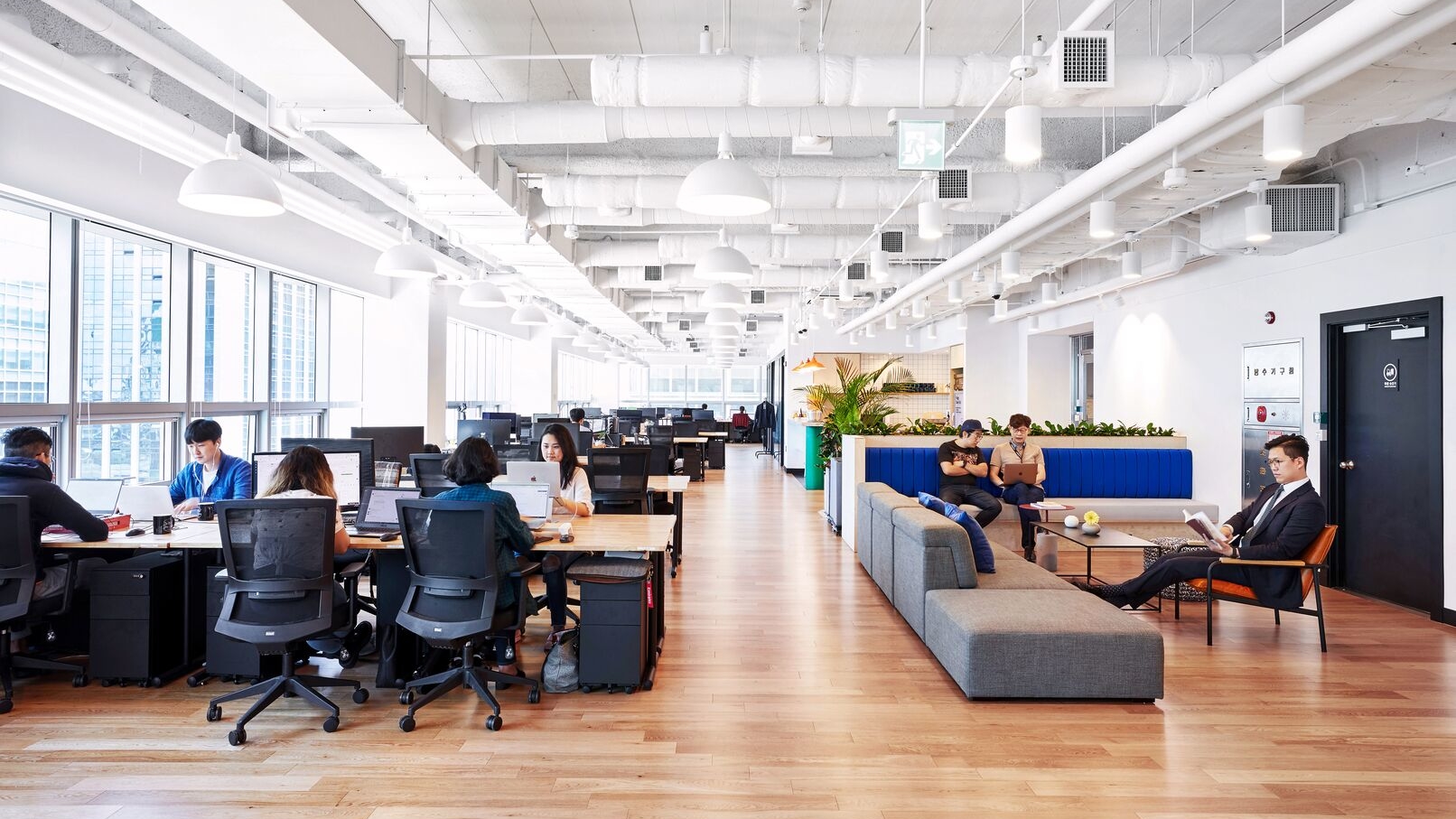

WeWork, the co-working space company, is akin to a real estate business, but tried to position itself as if it were a tech company. It raised over $22 billion (with a B!) in equity and debt. WeWork clearly has a market, and it’s a cool service, especially given remote work, but the economics were never going to work out to achieve the type of margins a tech company does (though it’s easy to argue it certainly worked out for the founder Adam Neumann).

I actually went to a WeWork recently in New York and thought it was great! It was packed to the brim, and leased offices were full. There’s clearly demand for this product as they’ve actually expanded their locations. However, it’s TBD whether it will succeed long term in its post-bankruptcy form. Funny enough, their prior mishaps probably increased their publicity and brand recognition to the point it could be a very good sustainable business… just maybe not worth $47 billion.

Less notably, many startups fail, not just because building one is hard, but because the founder realized they never matched with the funding model. Some founders create “lifestyle businesses” but realize it’s easier to just go get a 9-5 than run their own business, or conversely some raise money for startups and realize they don’t want to be in hypergrowth mode.

37Signals, on the other hand, is a great example of solid PMFFF. Led by the always spicy takes of DHH and Jason Fried, 37Signals is an extremely opionated business. The founders own most of the company so they only want to do the things they want to as founders. They have raised minimal funding because they want to maintain that control and build a business they want to. They don’t get caught up in shiny things. Love’em or hate’em, it’s hard not to respect people doing things on their own terms.

The tech industry is especially good at losing money. Growth is electric, but profits are elusive. We take an old school, economics 101 approach: Make more than you spend. That’s why we’ve been profitable every year we’ve been in business. It’s the responsible way to be reliable and take care of customers over the long haul.

37Signals clearly takes a certain approach and is pretty adamant about profitability. But the truth is none of these paths are right or wrong, and you can never truly A/B test history. It’s about finding the right intersection of PMFFF.

As an aside, I think a great place to find good non-venture-scale startup ideas is to find dead startups (https://yclist.com/ and filter by “Show dead”), and poke around to see which of them had strong products and revenue but failed because of a lack of founder or funding fit. Chances are there are niches and businesses there that could be very lucrative and attractive for the right person.

Getting personal - finding PMFFF with my own startup

I’ve been building Lizzy Sleep for the past year or so.

The very initial conversations I had with my co-founder, before we jumped into this venture together, was all around what PMFFF meant to us. There’s never a guarantee that you will align 100% forever, but our overall agreement on what success meant to us, and the type of business we wanted to build gave us a ton of confidence that we were the right partners.

So what kind of company are we trying to build? What is our PMFFF?

Product: We want to build the best app in the world to help parents teach their kids independent sleep skills. We’re open to exploring the different forms it may take as we iterate, but it will likely be a mix of personalized content, sleep tracking, and feedback for parents through LLMs and other interfaces. It will also incorporate the expertise of real sleep consultants and the human touch that parents sometimes need.

Market: This market is well validated by existing competitors and adjacent products, and people are always having kids! There is likely room for both a venture scale play that goes across many verticals, and many smaller ‘lifestyle’ business sized plays. There are a ton of B2C standard channels to explore as well as potentially more lucrative B2B plays. If we keep our business lean, there is plenty of market share to be had.

Founder: We want to build a company we’re proud of. We want to work hard and be successful, but not at the expense of our families or beliefs. We’re not in a hurry as we do not need cash flow from the business to sustain us personally. We want true freedom to pursue the idea as we wish.

Funding: Bootstrapping means we’re lean and maybe won’t go as fast as we want, but we can take time to explore the space and get the product right. We’re open to giving equity to future co-founders/early employees, but hope to get profitable and issue cash and dividends as necessary for more talent. We’re not saying no to future investment, but aren’t seeking it out. Given the possibly ephemeral market of our product (there could be natural churn as kids get older), venture scale probably pigeonholes us to a smaller definition of success.

PMFFF 🤝 Part-Time Tech

PMFFF reveals that there are many combinations of factors to build successful companies. Especially when you look at different founder and funding fits, you realize not everything has to be a full time job. Contractors, part-timers, fractional, full-time… all these can be tools in your arsenal to build a company depending on your goals.

When you look at businesses like Gumroad that hires mostly contractors, they can do this because the founder has total control and they’ve worked their way to profitability. They use this as a competitive advantage and realize they’re not beholden to typical assumptions of how businesses have to run.

So far at Lizzy Sleep, we’ve used a few contractors at key moments to help us build our initial product. This has been perfect for us as we’re trying to be lean and iterate methodically towards an incredible product.

We’re also looking to bring on another co-founder. So this post is actually a thinly veiled job listing 👀.

Work at Lizzy Sleep

We’re looking for a technical co-founder or founding engineer to work alongside us in helping build the product but also bring a jack of all trades mentality in helping us with go to market, promotion, and anything else a young startup may need. Ideally someone full stack with JS and React Native experience, but open to broader backgrounds. Bonus points: you’re a mom or dad and have experience with sleep or the parenting tech space, you have consumer mobile experience or any networks in the space. We’re open to different types of arrangements, not just full-time, and in compensating with a mix of cash and equity.

Oh, and you should feel like you resonate with our definition of PMFFF 🙂.

If that’s you, email [email protected] with whatever we need to know about why you might be a good fit!